Although more powerful computers continue to be developed day by day with innovations in hardware and material technologies, many problems still need thousands of years to be solved with these computers. Quantum computers developed with quantum physics features are expected to open a new page in solving these problems.

What is Quantum Computer?

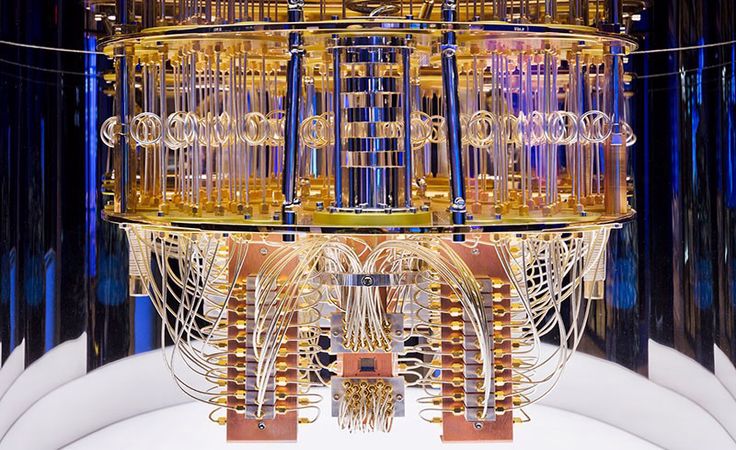

A quantum computer with 50 qubits produced by IBM

Transistors, which have been in use for many years as a semiconductor circuit element, can perform billions of operations smoothly and quickly today. A group of scientists, based on Einstein's Quantum Theory, started to encode electrons instead of transistors and to investigate whether computers working with electrons could be made. As a result of these researches, electrons; They noticed that in addition to the 1 or 0 position of the transistors, they can be in two positions at the same time in certain proportions, called superposition. Different from the smallest unit of classical computers, they named this smallest building block “qubit”. They named the sentence "Qubit", unlike the "bit", which is the smallest unit of classical computers. Thanks to superposition, 2? states can be examined in a single operation and events can be analyzed with a more holistic approach. These capabilities are; It enabled quantum computers to stand out from today's classical computers, to access capabilities that they could not reach, and to make transactions thousands of times faster, and encouraged scientists, companies and even governments to research this technology.

What Does Quantum Computers Mean for the Financial Industry?

What Does Quantum Computers Mean for the Financial Industry? Thanks to the security and competencies that quantum computers will provide, there are many advantages that they will bring to our lives in the coming period:

Transaction Ability

Even in a simple bill payment, many operations such as learning the amount, checking the balance, queuing the transaction, providing the collection and transferring the money to the other account are carried out simultaneously, within seconds, without being noticed by the user. Considering today's conditions, hundreds or even thousands of these transactions per second are performed by computers. Although it is certain that the number of these transactions will increase day by day, it is estimated that it will exceed the capabilities of classical computers. For this reason, it is theoretically proven that these operations can be performed by quantum computers, which are hundreds of times faster than classical computers, and that this complexity can be overcome.

Simulation Capability

Today, simulations are used in many areas from risk analysis to stock pricing, from market analysis to stock modeling in the financial sector. Considering that there are thousands of independent parameters in today's market conditions, it can take days, months or even years to make these simulations with today's computers. Therefore, only certain parameters are taken into account and limited iterations are made, ignoring other conditions. It is estimated that a solution can be developed for this with the high speeds of quantum computers and that more holistic and realistic results can be achieved in a much shorter time by taking all parameters into account. According to a pilot experiment [1] conducted by Deutsche Börse to explore the possible use of quantum technology in finance, a Monte Carlo Simulation with 1000 parameters was performed for risk analysis. In a situation where it is stated that a simulation that will take more than a few days will not be of any use, a quantum computer has demonstrated its capability by performing the simulation in just 30 minutes, which classical computers would do in 10 years.

Anti-Fraud System Improvements

One of the most widely used and known fraud methods, phishing, millions of people's computers are infiltrated annually and their account and card information are accessed. Against this, fraud detection and prevention systems give false alarms at a rate of 80% [2] and are not sufficient for fraud detection. It has been determined that financial institutions lose revenues of approximately $10 to $40 billion [2] annually due to fraud. Considering the holistic perspective, machine learning, artificial intelligence and reaction time of quantum computers, it is stated that they will play a very active role in detecting and preventing fraud.

Data Security

After it has been proven that many encryption algorithms, which can be considered almost impossible to solve today, can be solved with quantum computers, new algorithms have been sought. With the post-quantum era, it is predicted that new unbreakable algorithms will emerge thanks to quantum computers, and theoretical algorithms will be used in real life.

In addition to all these advantages that quantum computers will provide, there are also threats that may arise in case of malicious use, as is valid in every technology. For this reason, while creating an advantage by providing the creation of strong algorithms, it also brings stronger systems to crack these passwords.

Today, data is kept in storage centers encrypted with complex mathematical problems and algorithms, as well as security protocols to prevent data leaks. It does not seem possible to break these encryption algorithms, which are also used by banks, by today's computers. It is theoretically proven that most of these encryption systems, which are estimated to take billions of years to decipher even if all computers in the world unite, can be cracked in seconds or minutes with quantum computers. Based on this situation, there is also a situation where malicious people infiltrate the providers with the "harvest now, decrypt later" policy and wait for technologies that can crack this data after they have seized this encrypted data. Therefore, it is very important to protect data, even if it is encrypted.

Some Financial Institutions Experiencing Quantum Computing

J.P Morgan: Realizing the importance of quantum in 2020, J.P Morgan established an in-house quantum team with the support of the quantum technology firm Chicago Quantum Exchange. He continues to work on artificial intelligence, optimization and post-quantum encryption.

HSBC: Realizing the importance of quantum computers in machine learning, cyber security and risk analysis, HSBC has started various usage trials with a partnership of The European NEASQC [3] with a budget of $5.5 million for 4 years.

Citi Bank: The bank stated that quantum computers are among the 5 technology trends to be followed in 2019 and stated that it will stand out in areas such as developing trading algorithms, preventing fraud, portfolio optimization and risk analysis. It also invests in quantum startups such as 1QBit and QC Ware.

Wells Fargo: With the agreement made with IBM and MIT in 2019, the bank started to research quantum technology, and stated that banking will be faster, safer, smarter and easier with quantum technology, and has already started its preparations against these changes in the financial sector.

ABN AMRO: In 2020, they started to explore possible usage areas of quantum computers with Rabobank, which also provides service in the Netherlands. Quantum algorithms and cryptography are his main areas of interest.

Barclays: Barclays, one of the financial companies that fall for quantum technology the most, is actively involved in pioneering research and leads studies on secure transactions with quantum computers. According to Barclays, even if they are not in use today, within the next 10 years, quantum computers will begin to be actively involved in the financial industry.

So, How Ready are Quantum Computers for Use?

CBInsights: What is Quantum Computing?

Although intensive studies continue, the number of qubits owned by quantum computers is increasing day by day. The computer title with the highest qubit today is the computer with 128 qubits produced by Rigetti in 2019 [4]. It is claimed that a 1000 qubit computer will be developed by IBM in 2023. Today, computers with thousands or even millions of qubits are needed for targeted algorithms and operations. Even without large-scale algorithms, the entry of quantum computers, which have the capabilities to make our lives easier, in the next ten years is considered certain by the authorities.

[1] Deutsche Börse Group — Quantum computing opening up new business horizons (deutsche-boerse.com)

[2] [u]Quantum computing use cases for financial services | IBM[/u]

[3] NEASQC: Next Applications of Quantum Computing

[4] MIT, Qubit Counter’a göre